After years in the tech sector, for engineering, entertainment, travel & finance companies, I’ve turned my focus to blockchain and building a startup, Krypton, to help companies realize their distributed applications.

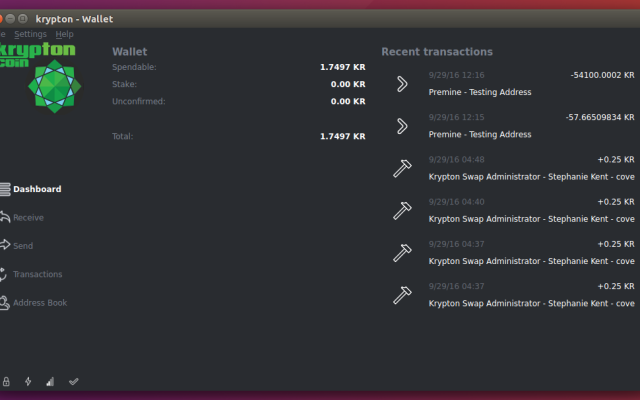

KR is my vision for an ultra-fast, public and open source blockchain that employs all of the distributed technology of Ethereum, namely smart contracts, dAPPs, DACs and DAOs, with the best security features of the Bitcoin protocol.

The practical-use cases for this technology are set to explode, from smart contracts for business systems to custom blockchain solutions for FinTech and Internet of Things devices.

Krypton is seeking Tier 1 financing and then will be hiring client and language developers to rewrite the KR client in the most secure language, C, and also to code a new smart contract language to replace Solidity, ultimately making KR the best public blockchain solution available.

Developers with experience in C and Solidity, please apply at Krypton’s Slack: http://Slack.Krypton.Rocks

Investors, let’s create something fabulous. I’m building a Blockchain-as-a-Service (BaaS) corporation and a badass, open source, public blockchain. Join me. Let’s code the future.